Sourced by Silke Brand | The OpenSea Volume in October 2022 is the lowest since June 2021. Leading NFT marketplace OpenSea is having a hard time maintaining its share in the NFT market confronted with the strong competition from the likes of MagicEden and LooksRare. OpenSea has lost over 30% of the market share to upcoming NFT marketplaces, although its decline is caused partly due to the declining NFT trades in Q3 in general.

Overall NFT Sales Drop by 77% from Q2 to Q3

An analysis by popular crypto exchange Binance revealed that NFT sales dropped by 73% in Q3 2022, which it says is down to the bear market that started in June 2022. Despite the current winter in the NFT market, new NFT marketplaces like MagicEden, Cryptopunks, X2Y2 and LooksRare are determined to grab the market from OpenSea’s monopoly and turn it into an oligopoly.

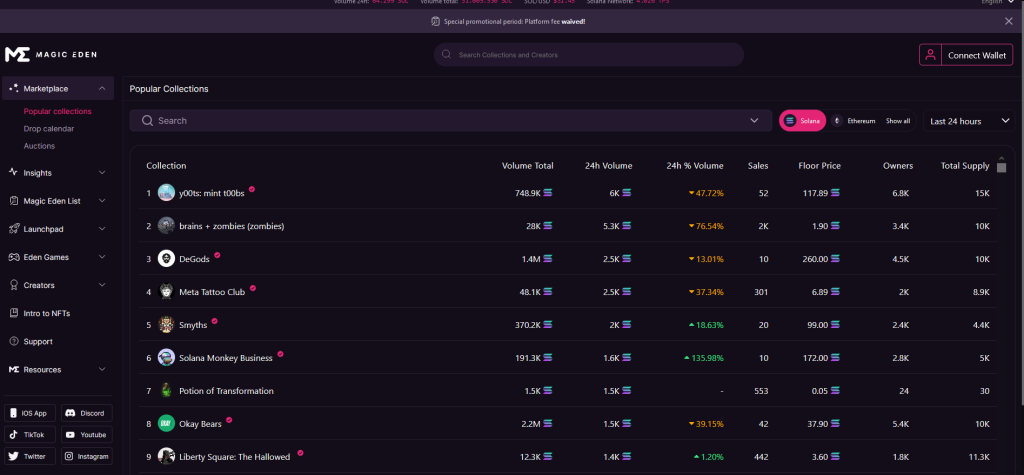

Of all of these competitors, Solana-based NFT marketplace MagicEden has outpaced the rest to become the most worthy competitor to dethrone OpenSea.

Binance’s findings were similar to crypto aggregator CoinGecko’s observations. In its Q3 2022 Cryptocurrency Report, CoinGecko noted that the “NFT winter is here,” since the quarter-over-quarter (QoQ) trading volume had dipped by 77%. According to CoinGecko, the trading volume across the top five marketplaces dropped from $13.5 billion in Q1 to $9.3 billion in Q2 and later to a meagre $2.1 billion in Q3.

MagicEden’s Dominance Increases by 13%

Of the five marketplaces, Magic Eden is the only one that registered notable growth in September “doubling its mom (month-over-month) volume and dominance while the rest of its competitors continued to slip.” Available data shows that it increased its dominance from 9% to 22% while OpenSea’s grip fell from 90% to 60%.

This impressive growth of MagicEden comes at a time when the marketplace has shifted to optional loyalties which has divided the community.

OpenSea’s trading volume fell to new lows of $303 million in October 2022, which was 94% lower than all-time high of $4.86 billion in January 2022. A major factor behind this could be due to Solana’s marketplace stealing market share, and also the broader NFT winding down trend. It was noted that the number of adults 18 or older buying NFTs declined from 76% in 2021 to 51% in 2022.

Another contributory factor could be the drop in floor prices of NFTs. The price floor for the Bored Ape Yacht Club NFT collection dropped from a peak of 144.9 ETH on May 1, 2022, to 64.7739 ETH at November 1st. CryptoPunks, another popular NFT collection, saw its floor price drop from around 122 ETH on Aug. 30, 2021, to 100 ETH.

It should also be noted that the number of NFTs minted decreased in October 2022, suggesting that NFT artists were creating fewer collections. Moreover, transactional data from DappRadar showed a sharp decline in NFT transactions on the secondary marketplace. This went down from over $406 million in May 2022 to $7.63 million at press time, a drop of 98%.