Sourced by Silke Brand |“It is not the most intellectual of the species that survives; it is not the strongest that survives; but the species that survives is the one that is able to adapt to and to adjust best to the changing environment in which it finds itself.”

– Charles DarwinA hint of gold amid the current crypto market downstream – Solana (SOL) begins to recover.

Lets take a look back at the last week that shaked the crypto world once again.

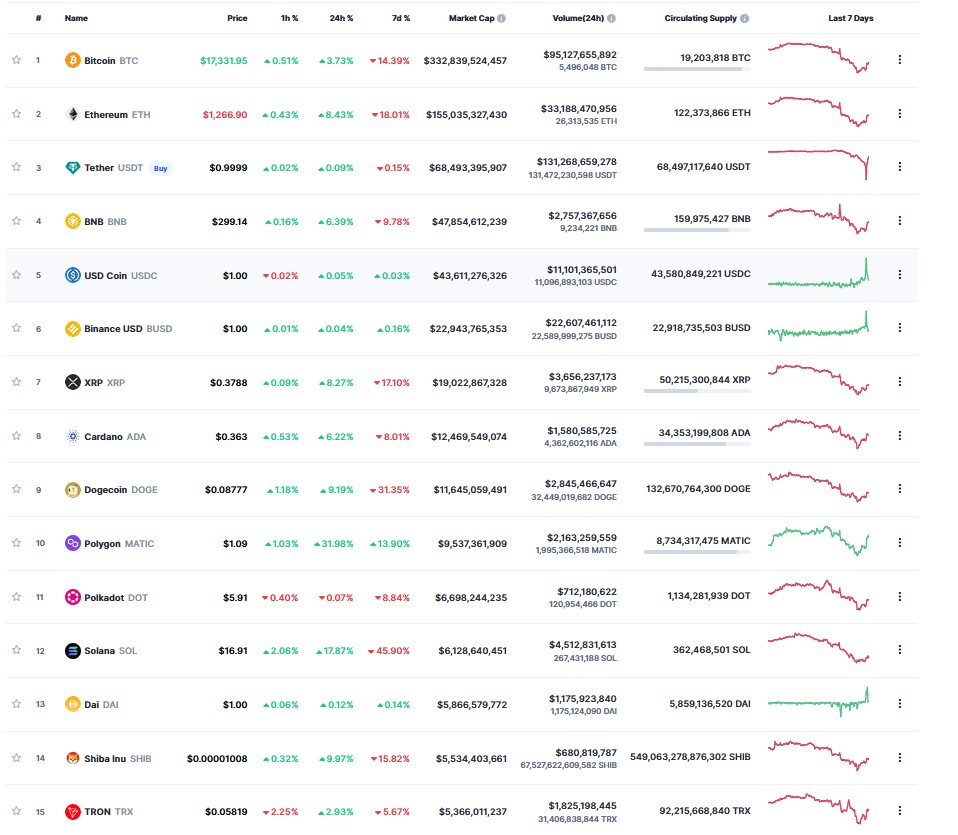

With SOL trading at 16,99 USD at time of writing it means that for now the base has been reached after it collapsed from 33,07 USD on November 7th 2022 to 12,51 USD on November 9th 2022. SOL had lost 62% of its value in just two days and fell in the CoinMarketCap.com ranking from number 10 (November 8th 2022) to number 15 (November 9th 2022). Today on November 10th it has gone back to number 12 outranking again DAI, Shiba Inu and Tron. This means that the crypto asset has grown its market cap by 47% in the past 24 hours – from 4,6 Billion USD back to 6,77 Billion USD. But remember, just two days ago its market cap was at 11,22 Billion – so it is still roughly 40% below that mark.

What has happened the last two days in the crypto scene?

Crypto assets plummeted across the board this week after Tuesday’s November 8th stunning collapse of embattled exchange FTX’s native FTX Token (FTT).

FTX is battling what it’s described as a “liquidity crunch” after facing a flood of speculation that the exchange is relying far too heavily on holdings denominated in FTT.

On Monday, Binance CEO Changpeng Zhao stated on Twitter that his company had signed a non-binding agreement to acquire FTX, pending a full review of the company’s balance sheet. Binance, however, pulled out of the deal on Wednesday, saying FTX’s issues are “beyond our control or ability to help.”:

As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of https://t.co/FQ3MIG381f.

— Binance (@binance) November 9, 2022

On Wednesday, the Singapore-based exchange Crypto.com announced that it had suspended deposits and withdrawals of USDC and top stablecoin Tether (USDT) on the Solana blockchain.

Says Crypto.com CEO Kris Marszalek:

USDT/USDC on other chains operate normally of course. FTX was an important bridge/venue for SOL-based stablecoins, we do not want any additional risk to our users coming from this area, hence disabling it.

Kris Marszalek

In related news, Anatoly Yakovenko, the co-founder of Solana Labs, confirmes on Twitter that his company didn’t have any assets on FTX.

Solana Labs, a US corp, didn’t have any assets on ftx.com, so we still have tons of runway,

and luckily still a small team.Anatoly Yakovenko

and

Runway is in $, ~30 months at current burn. Learned our lessons in 2018.

Anatoly Yakovenko

A little bit of a background story….

OK so it starts years ago. Binance was an early investor in FTX.But FTX starts growing like crazy. They become the #2 biggest exchange Steph Curry, Tom Brady, they cut huge marketing deals. SBF (Sam Bankman Fried) becomes the famous “fro of crypto”.They started as friends, now competitors. Binance #1 FTX #2 (coinbase and others are smaller) Binance decides to sell it’s stake in FTX. As part of the buyout, they agreed to take $2B of it in “FTT” — a token that FTX created that it uses for trading fees.So now – Binance and FTX are friendly competitors Binance owns a sh*t ton of FTT ($2B) There’s not a lot of FTT trading volume (this is important soon).Two days ago, CZ [Remark: Changpeng Zhao the CEO of Binance] comes out and says SBF has been talking sh*t about them to regulators lobbying in a way that would hurt binance.So he announces publicly on twitter to his 7M followers that he’s going to DUMP his entire $2B FTT stash.Anyone holding FTT knows this is bad news. $2B of sell pressure would crush price.

So they start to panic sell Price of FTT drops like 15-20% overnight. Nobody wants to buy FTT (too risky, a whale is about to dump) and everyone wants to sell. Number go down.Enter Alameda – the hedgefund/market maker Sam started before FTX.

They are kings. But news leaks showing the emperor has no clothes They have ~$12B in assets, $7b ish in liabilities…but half their “assets” are in FTT token which is plummeting & illiquid Alemeda might die.If Alameda is in trouble, FTX might be too. They are sorta sister companies. Market makers on FTX. And possibly hold/trade customer deposits. The relationship has been unclear for years. (achilles heel?)But most people think of FTX as a blue chip company. Sam is famous. He’s a genius right? They wait for he or alemeda to show they are in good health *narrator* but they were not in good health.Sam tweets saying everything is “fine” but it feels to all of crypto like a girlfriend saying “i’m fine” but she’s not fine. https://twitter.com/SBF_FTX/statusAlemeda’s CEO Caroline Ellison comes out and says they will “happily” buy the FTT token as it plunges But something tells us that it’s not so happy, even with the exclamation mark.6. Nov.“@cz_binance if you’re looking to minimize the market impact on your FTT sales, Alameda will happily buy it all from you today at $22!”[Remark: it seems that the Tweet has been deleted by now on November 11th 2022]24 hours pass. If they had the financial strength, they would have shown it by now.

This starts to feel like the “steady lads” moment right before luna collapsed.People freak out. Start withdrawing funds from FTX.

Ya know, just in case it collapses like celsius, blockfi, voyager, luna all did in the past year $1B+ of withdrawals.FTX is facing a liquidity crunch.More silence (wtf), withdrawls paused on FTX (double wtf).Anyone holding FTT knows this is bad news. $2B of sell pressure would crush price. So they start to panic sell. Price of FTT drops like 15-20% overnight. Nobody wants to buy FTT (too risky, a whale is about to dump) and everyone wants to sell. Number go down.Then today (November 8th 2022) @SBF_FTX comes out and says they are entering a “strategic transaction” with binance strategic transaction? Best code phrase since Bill.CZ clears it up “FTX was in trouble. We bought them to save them” Binance basically started a rumor, made a threat, and ended up buying its biggest competitor overnight. Magnus carlsen approves.For now the drama ends crypto crisis averted if ftx failed…that would have been devestating for all of crypto.Sam had become the main character you never want to be the main character.Shaan Puri

But as we know today on November 11th 2022 due diligence from Binance showed there is not a lot that can help FTX from complete failure.

Whether CZ from Binance is the bad guy or the good guy in this game? Who knows.

He says to his employees that he has done everything right and everything that he could to save FTX and that a failure of the 2nd largest Crypto Exchange does not at all help to build trust in the crypto industry among the potential users.

Well, that – at least – is something to think about.

In true and due diligence.

Sources:

Twitter

CoinMarketCap